Marubozu pattern

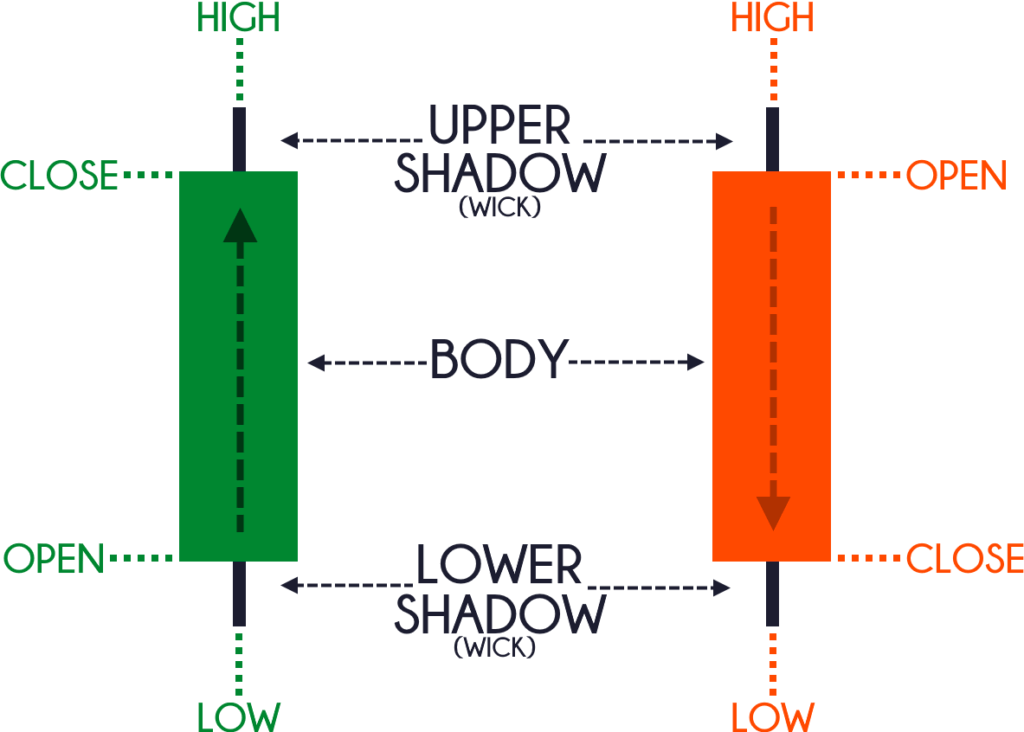

This pattern has a large body and ideally doesn’t have a wick or shadow.

However, a very small shadow is acceptable in natural market conditions.

There are two types of Marubozu patterns;

- Bullish

- Bearish

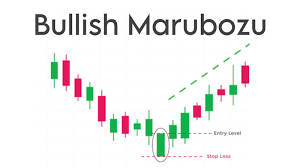

Bullish marubozu.

Bullish marubozu candle has an either green or blue color

In this pattern, the open price is the low price and the close price is the high price.

If it appears in an upward trend it indicates that the upward trend will continue.

But, if it appears in a downward trend then it indicates a trend reversal.

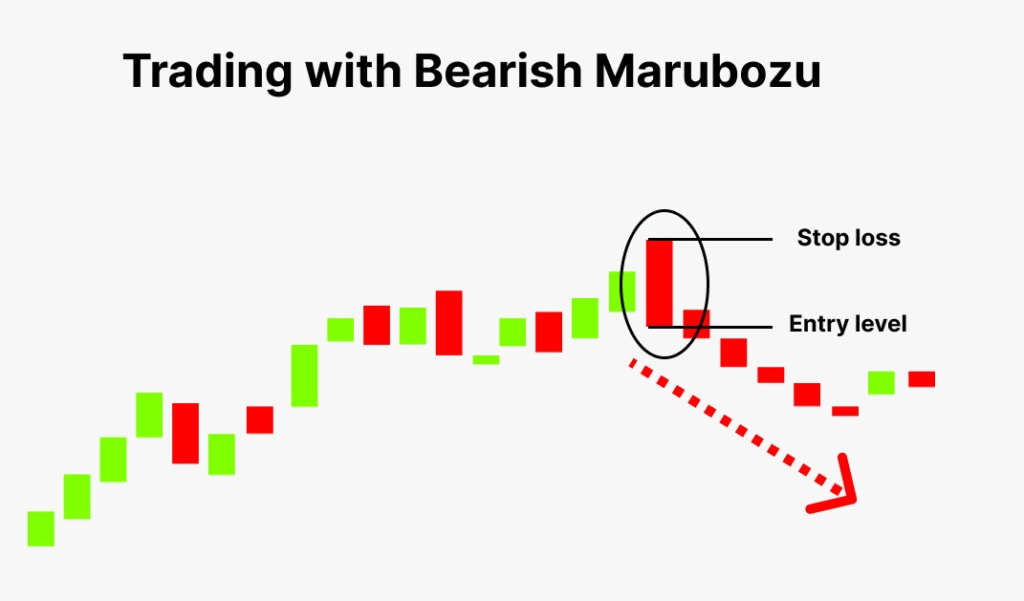

Bearish marubozu.

It is a red colored candle

In this pattern, the open price is the high price and the close price is the low price.

If it appears in a downward trend it indicates that the downtrend will continue

But, if it appears in an upward trend then it indicates a trend reversal.

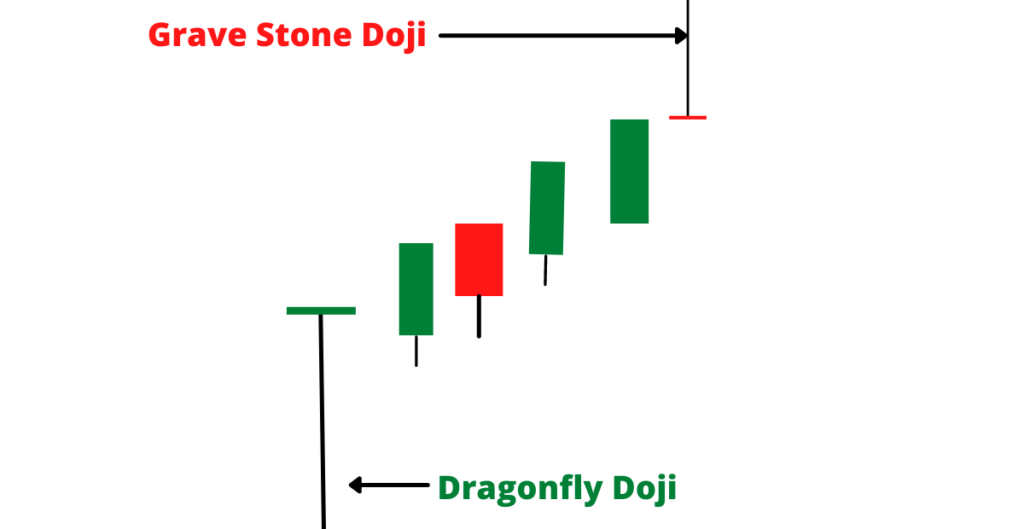

Doji candlestick pattern

The two main types of doji candlestick patterns are:

- Gravestone doji pattern

- Dragonfly doji pattern

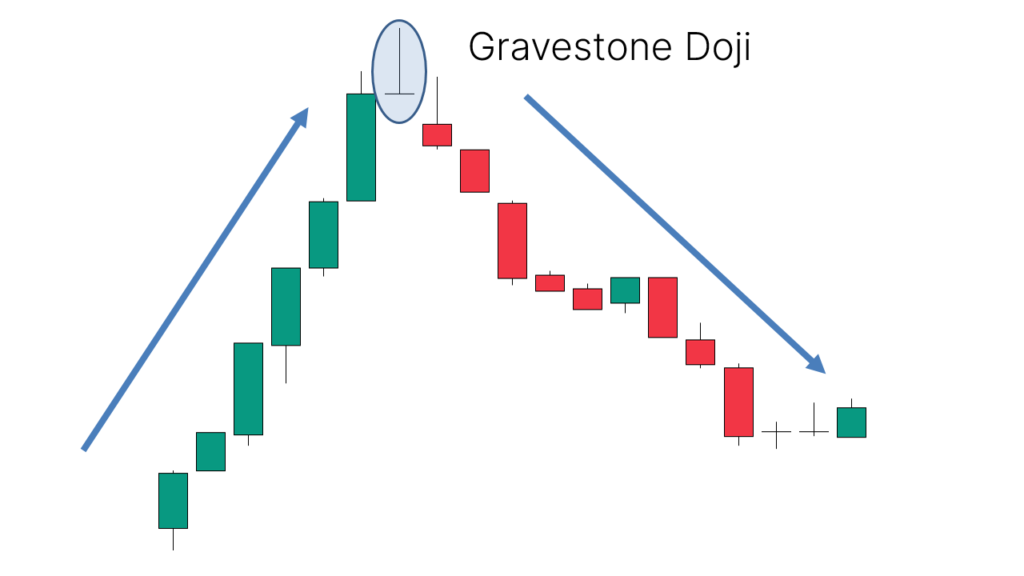

Gravestone doji pattern

A gravestone doji pattern is formed when open, low, and closing prices are all near each other with a long shadow in an upward direction.

It is a bearish reversal pattern.

It is represented by an inverted T with a long upper shadow.

It can be found at the end of a downward trend.

It is confirmed when the next candle provides confirmation of a reversal.

We have to take a short position after confirming a gravestone pattern.

Dragonfly doji pattern

Dragonfly doji pattern is formed when open, high, and closing prices are all the same. And the low is lower than the other three.

It can be found after a price rise or decline.

If the dragonfly doji pattern appears after a price rise this indicates that the price will fall.

To confirm we have to observe the next candle. If it moves lower this will provide confirmation.

If the dragonfly doji pattern appears after a price decline this indicates that the price will rise.

To confirm we have to observe the next candle. If the next candle rises this will provide confirmation.

Pingback: Bullish Engulfing Pattern - Learn Technical Analysis