In this post, we’ll look at the “bullish engulfing” candle, how to confirm the bullish engulfing pattern, how to trade with it, the difference between bullish and bearish engulfing, and the reliability of the pattern.

Among the many tools available to traders, candlestick patterns are one of the key concepts in technical analysis.

They are globally followed and applicable in all assets equity, commodity, and currency.

The engulfing pattern both ” bullish and bearish engulfing candlestick patterns” stands out as a versatile and dependable indication of trend reversals.

Understanding bullish engulfing pattern.

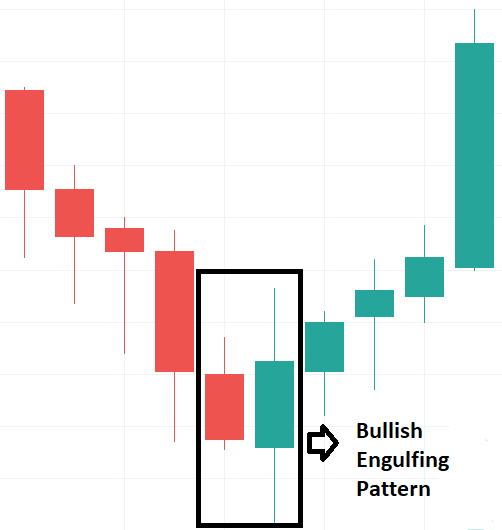

The bullish engulfing pattern has two candles.

The first candle is a smaller bearish candle that forms on day one and the second candle is a larger bullish candle that forms on day two.

The second bullish candle (engulfing candle) entirely covers (engulfs) the first candle. And therefore the pattern is called the bullish engulfing pattern.

The bearish candle is usually red or black and the bullish candle is green or white in color.

The formation of the first candle is not that significant.

However, the formation of the second indicates that the bears did not get that far before the bulls took over and pushed prices higher.

Hence confirming the formation of the pattern.

How to confirm a bullish engulfing candle

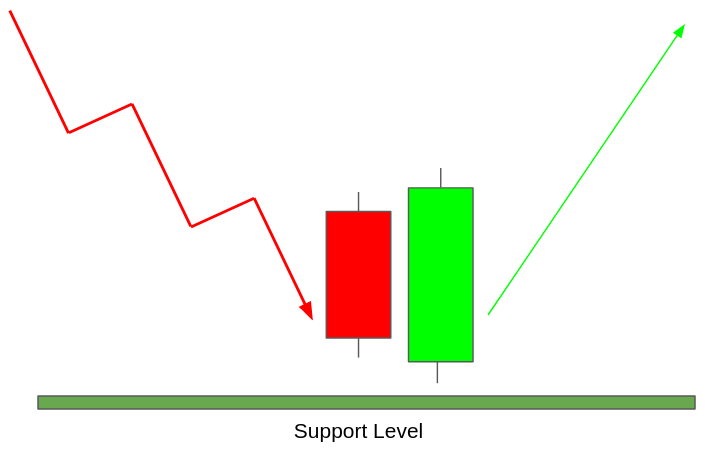

This pattern appears at the end of a downward trend and indicates a trend reversal which means the price is going to rise.

For an upward trend to continue two factors should be kept in consideration;

- Check if there are at least 4 red candles before the first candle of the pattern.

- At least three green candles after the pattern forms.

How to trade with a bullish engulfing pattern

Traders can take a long/buy position above the high of the second candle (engulfing bullish candle).

And to manage risks the stop loss can be put below the low of the first candle (bearish candle).

- Confirmation indicators: Use additional indicators, such as moving averages or the relative strength index (RSI), to provide confirmation.

- Multiple Timeframes: To increase the pattern’s dependability and impact, confirm it throughout a range of timeframes.

- Analysis of Trade: Failure to consider trade volume while trading with a bullish engulfing pattern can result in incorrect indications. A way that is accompanied by high trade volume is more reliable.

Although it’s a powerful pattern you can’t solely rely on this pattern. You must include a few other strategies in order to place a trade.

How reliable is the bullish engulfing candle

Candlestick patterns are not 100% reliable one must consider other important factors as well technical indicators, multiple timeframes, volume, and overall market conditions as well.

However, according to Thomas N. Bulkowski, it correctly predicts a bullish reversal 63% of the time.

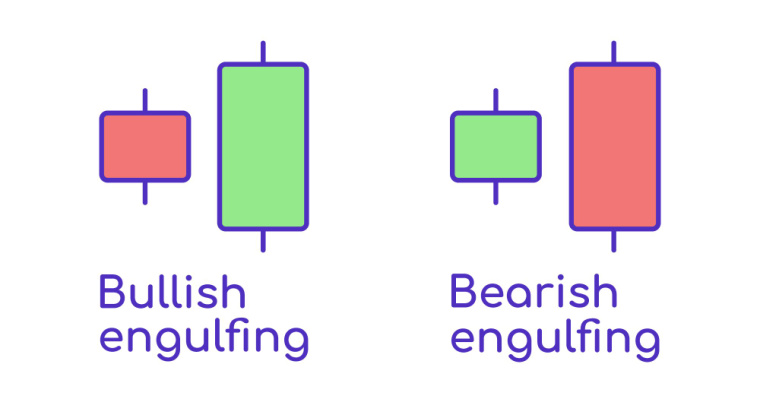

Difference between bullish & bearish engulfing.

The bearish engulfing pattern is the opposite of the bullish engulfing candlestick pattern.

The pattern comprises two candles like a bullish engulfing pattern.

However, in the bearish engulfing pattern, the first candle is a bullish candle which is engulfed by a bearish candle.

And a bearish engulfing candle appears in uptrends and signals a bearish reversal.

Related articles

This has been a guide to Bullish Engulfing Pattern and its meaning. You may also find some useful articles here :