Three outside candlestick pattern

The two types of three outside candlestick patterns used in technical analysis are;

- Three outside up

- Three outside down

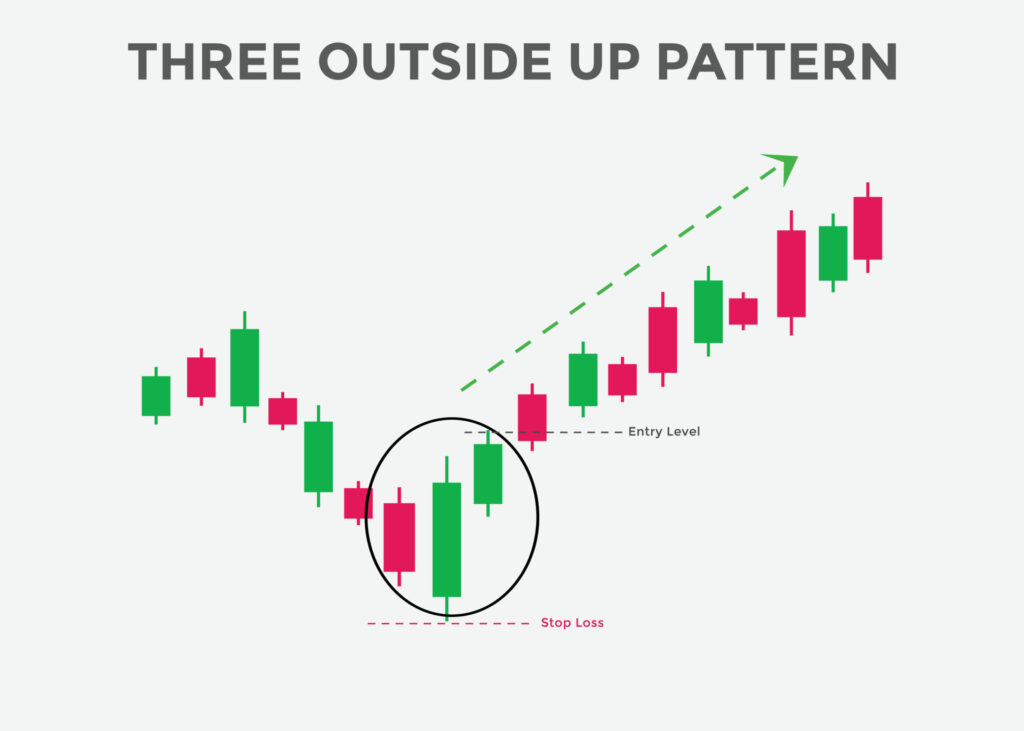

Three outside up :

The “Three outside up” pattern consists of three candles:

- Bearish candle

- A bullish candle with a long body engulfs the first candle

- Bullish candle with a close price higher than the second candle.

It can usually be found during a bearish trend.

It is a trend reversal pattern and it indicates an upside reversal.

We have to take a short/sell position just below the low of the third candle. And put stop loss just above the high of the second candle.

The entry and stop loss is shown in the diagram below.

When to exit the trade is determined by the trader.

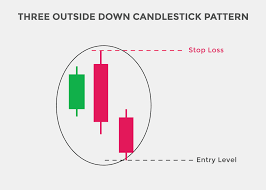

Three outside down :

The “Three outside up” pattern consists of three candles:

- Bullish candle

- A bearish candle with a long body engulfs the first candle

- Bearish candle with a close price lower than the second candle

It can usually be found during a bullish trend.

It is a trend reversal pattern and it indicates a downside reversal.

We have to take a short/sell position just below the low of the third candle. The stop loss is kept just above the high of the second candle.

Entry and stop loss is shown in the diagram below.

When to exit the trade is determined by the trader.

Three inside candlestick pattern

The two types of three inside candlestick patterns used in technical analysis are;

- Three inside down

- Three inside up

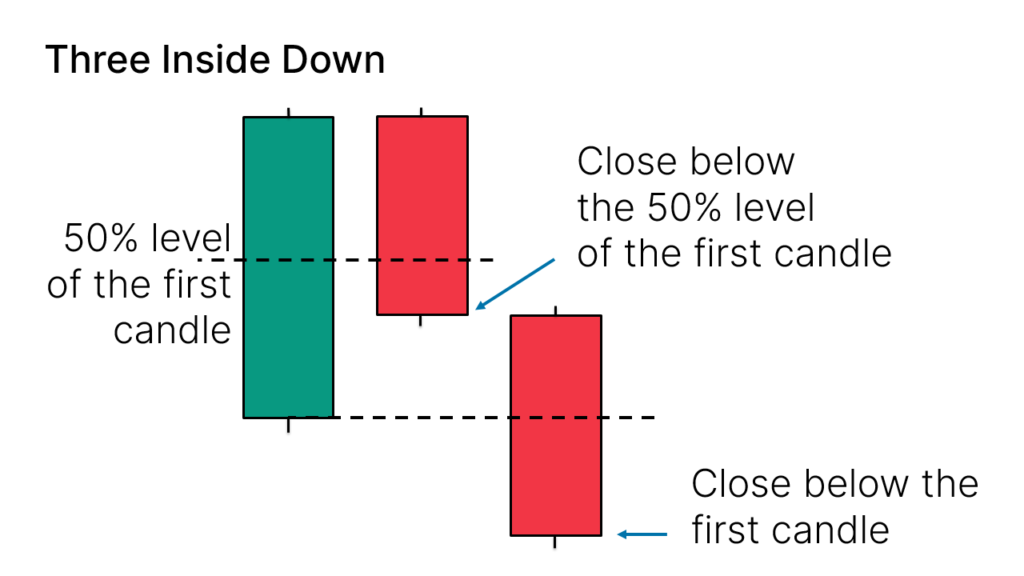

Three inside down

- Bullish candle

- Bearish candle which is at least half the length of the first candle

- Bearish candle. Its closing price is lower than the opening price of the first candle.

It can usually be found at the end of an upward trend.

Three inside-down pattern consists of three candles;

It is a trend reversal pattern and it indicates a bearish reversal.

We have to take a sell position below the low of the third candle and put a stop loss above the highest price of the pattern.

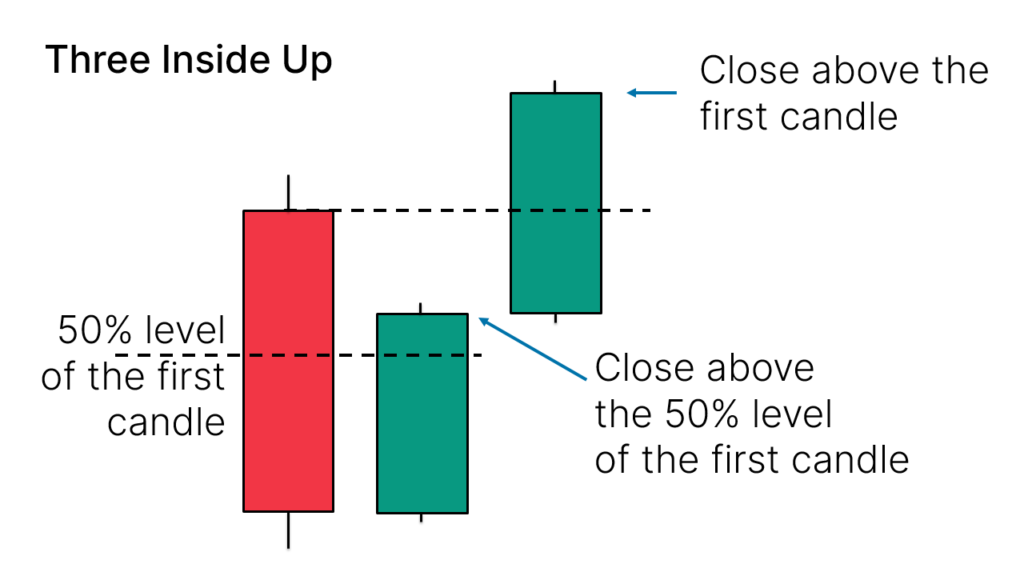

Three inside up

Three inside up pattern consists of three candles;

- Bearish candle with a long body

- Bullish candle which is at least half the length of the first candle

- Bullish candle. Its closing price is higher than the opening price of the first candle.

It can usually be found at the end of a downtrend.

Three inside up is a trend reversal pattern and it indicates a bullish reversal.

We have to take a long position above the high of the third candle and put a stop loss above the lowest price of the pattern.

Pingback: Trend reversal and Neutral patterns. - Learn Technical Analysis

Pingback: what is a candlestick pattern | Guide for beginners - Learn Technical Analysis